Most states throughout our Nation have put into effect the stay-at-home initiative to keep people safe and keep unnecessary travel to a minimum due to COVID-19. The effect that this has had in housing markets is very different state to state. We have pulled information from multiple sources on what we can hope to expect with our local housing market and economy. According to John Burns Real Estate Consulting they have outlined several facts to take into account when considering the economic impacts in our areas. JBREC believes if we want to know what Utah's Real Estate Market will encounter there are a few key questions to ask looking at the Nation as a whole:

- Demand: What will demand look like once stay-at-home initiative is removed? By price point and rent range? By submarket? Two decades of forecasting home prices and sales volumes by metro area have taught us that job growth and losses in the industry sectors most important to the local economies will play a key role in this answer. Mortgage financing will also be critical in determining whether the demand shifts to rentals or for-sale housing.

- Supply: What will supply look like? Supply was balanced heading into this recession. JBREC calculated that the country needed 1.4 million housing units/year, and that is exactly what the industry supplied. But construction was overweighted to multifamily units. Over the next 18 months, we expect multifamily construction will add new supply, while single-family construction will certainly slow down, limiting that inventory and helping the market recover more quickly.

Salt Lake City is considered to be one of several "Boom Markets" throughout the country. Metro areas like Salt Lake City, Austin, Phoenix, and Tampa have all had less exposure to the industries most impacted by COVID-19 and are also affordable markets with pro-growth governments. JBREC has also rated all four for-sale housing markets as Strong or Very Strong in their February research reports, and we expect them to be among the first to earn their ranking back. Each of these markets also had high apartment construction, but vacancy rates below 6.0% should help them weather the storm of move-outs and completions.

They have pointed out several metro areas that are considered to have less competition. Las Vegas, Miami, and Orlando are on their list of markets to recover last due to their reliance on tourism. With travel bans, tourism, and unnecessary travel all on hold; these areas of our Nation will be the last to recover. Read more about their thoughts online.

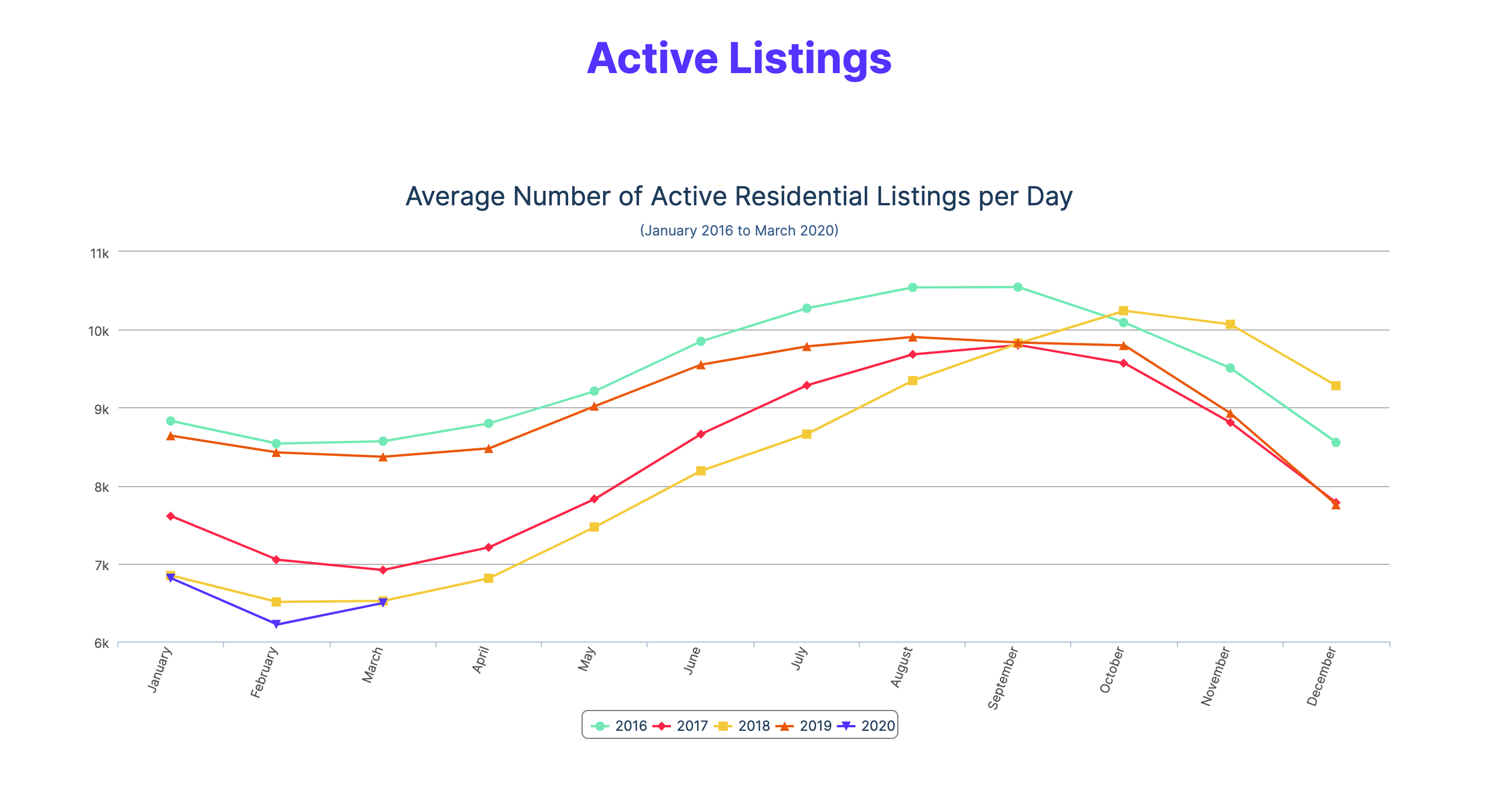

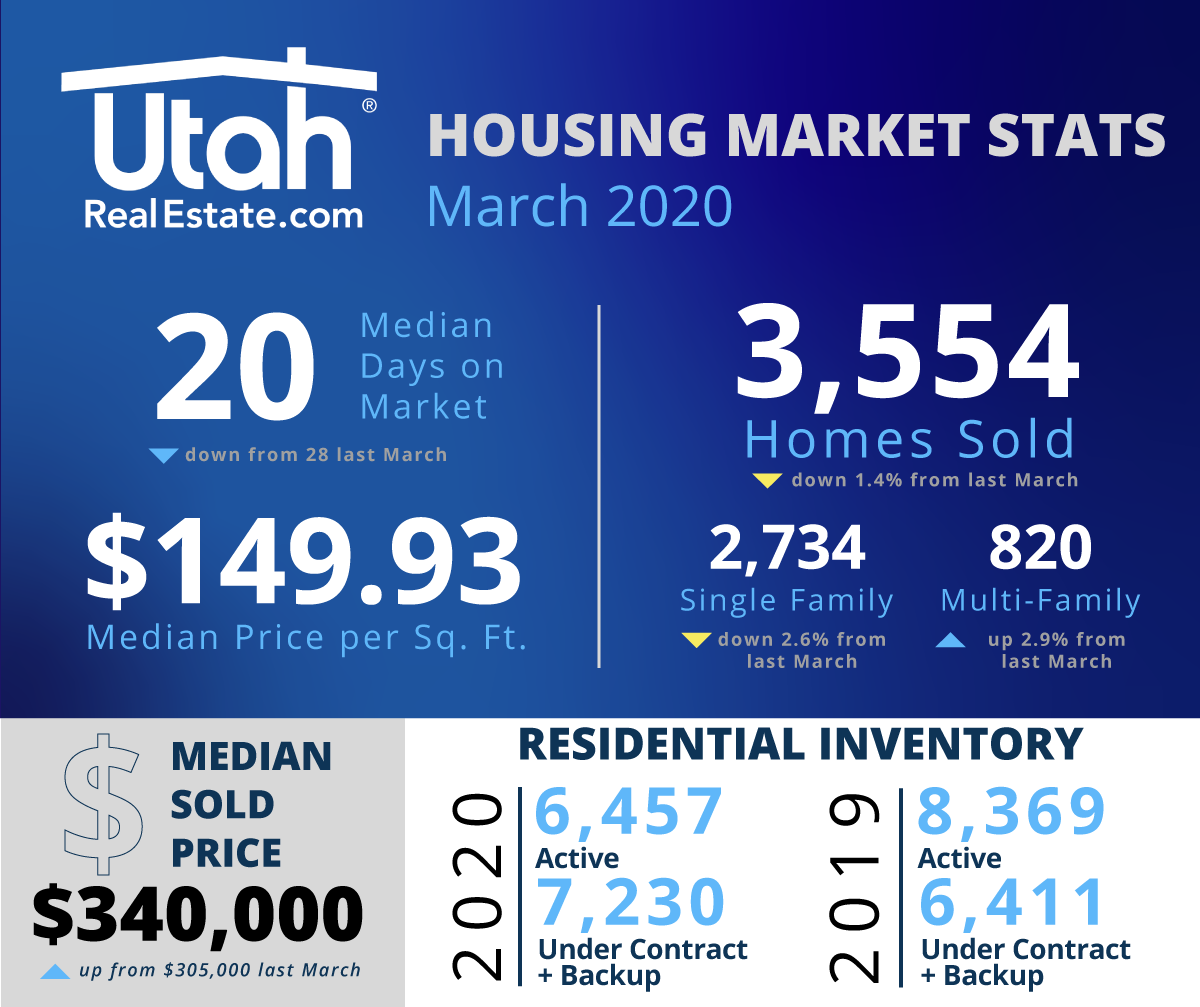

Utah Real Estate MLS shares their market statistics from March with us to show where we are at as a state. In March our average sale price was $340,000 which is up from $305,000 last March 2019. If we peek at our current inventory of active residential listings we see relatively strong numbers across the board holding through the most unsure month we have seen so far. With 6,457 active listings and and 7,230 under contract we can see that the demand for homes in Utah is still very strong.

In 2019 we had 8,369 active listings and only 6,411 under contract in March. Total residential homes sold last month is only down 1.4% from March 2019. Considering the amount of uncertainty people have had over the last two months these are really positive numbers for our state. You can find out more and read further insight at UtahRealEstate.com and stay up-to-date daily on market statistics.

For more information and market opportunities, join our newsletter or contact our consulting expert Regan Richmond.